# Meta Continues to Solidify its Core Enterprise in Q1

Meta has revealed its first earnings report of 2025, exhibiting a rise in total customers, and a strengthening in its advert enterprise, solidifying its core, and enabling it to proceed betting on next-level experiments that can guarantee its ongoing relevance.

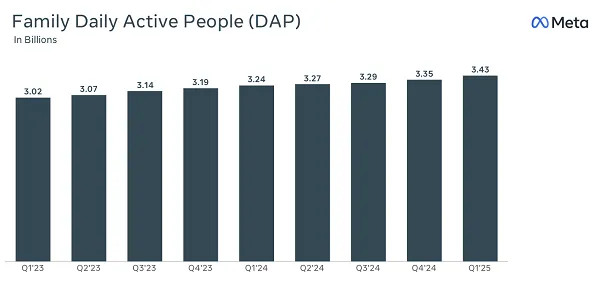

First off, on utilization. Meta added an extra 80 million customers throughout its Household of Apps in Q1 (quarter-over-quarter), taking it as much as 3.43 billion customers on common in March 2025.

It’s slightly annoying that we don’t get the app breakdown that we used to, by way of what number of customers every app has. However in total progress phrases, Meta continues so as to add increasingly customers, because it branches into new markets, and sees broader adoption of Fb, Instagram, Messenger, and WhatsApp.

And now Threads as properly.

Threads is as much as 320 million customers, and we could get an replace on this as a part of Meta’s earnings name, including one other string to Meta’s bow on this respect.

To place this in perspective, 3.43 billion represents round 40% of your entire international inhabitants. And once you think about youngsters below 13, who can’t use most of Meta’s apps, and areas the place its apps aren’t obtainable (like China), that could be a staggeringly excessive degree of market attain for any single firm.

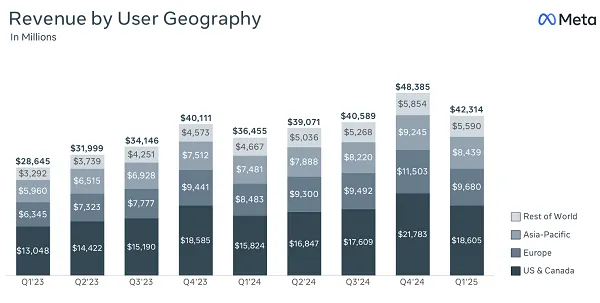

Which can be why Meta’s advert enterprise stays so robust, as a result of nobody gives the breadth of protection that Meta can.

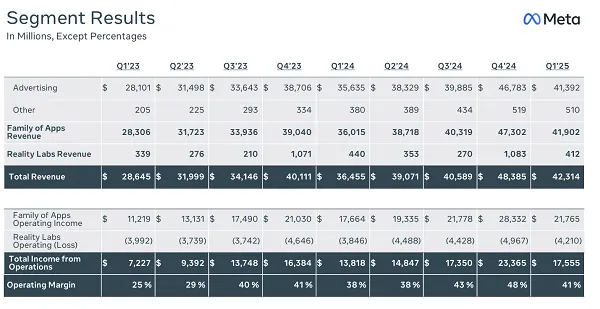

On that entrance, Meta introduced in $42.31 billion for Q1, a rise of 16% year-over-year.

One other enormous consequence, although it is usually value noting that its Actuality Labs income, the division accountable for its wearables, together with its Ray Ban sensible glasses, noticed a decline in income on Q1 final 12 months.

Meta’s Ray Bans are rising in reputation, with the addition of AI options serving to to propel them to a different degree. As such, I anticipate that this quantity will rise once more all year long, however it’s value noting that Meta’s nonetheless engaged on making actual cash from its wearables division.

Its growth of recent know-how can be costing so much. Meta’s whole prices and bills for Q1 had been $24.76 billion, a rise of 9% year-over-year, whereas its capital expenditures (which incorporates the event of its rising AI infrastructure) reached $13.69 billion.

Meta’s set to spend large time on AI datacenters and connective components, because it appears to be like to guide the AI race, whereas it’s additionally constructing its VR metaverse on the similar time, in addition to AR glasses, and extra.

All of it will proceed to maintain Meta’s prices excessive, which is why it must continue to grow its advert enterprise, in an effort to gasoline its next-level plans.

On that factor, Meta additionally reviews that advert impressions had been up 5% year-over-year, whereas its common value per advert elevated by 10%.

It’s a stable construction for growth, with its core advert enterprise enabling ongoing funding, and proper now, it undoubtedly looks as if Meta’s heading in the right direction to go from energy to energy, whereas additionally remaining agile sufficient to regulate to no matter large tech shifts come its approach.

I imply, it form of confirmed that with AI. Meta’s been growing its personal AI components for over a decade, however as quickly as OpenAI went public with ChatGPT, each different platform needed to scramble to catch up, and be sure that they’re personal AI tasks remained related.

Meta was ready to do that higher than anybody else, and it’s now arguably in the perfect place to capitalize on the alternatives of gen AI.

However that was an enormous shift. Meta modified focus from the metaverse, and the subsequent stage of digital connection, and re-aligned round AI, as kind of a center step in its broader plan. It’s now embedded that as a key step, whereas nonetheless sustaining deal with its larger finish objective, in VR engagement, and it’s superb to see simply how adaptable such an enormous firm can nonetheless be within the face of those shifts.

Which is another excuse why Meta stays a powerful guess, and the most definitely winner in the long run, on all fronts that it’s engaged on. It has a stronger underlying enterprise basis, bigger scale, and extra sources than nearly every other firm.

And its advert enterprise continues to develop, increasing its worth on this entrance.

Andrew Hutchinson