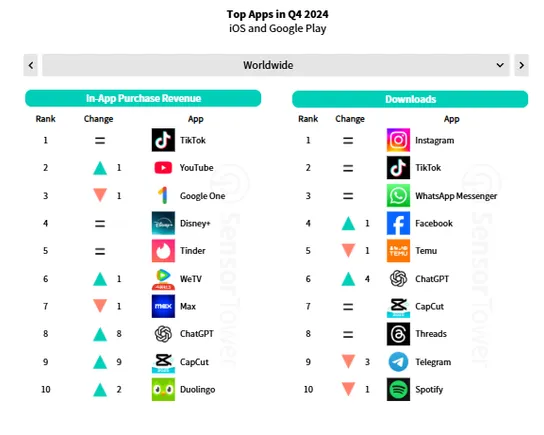

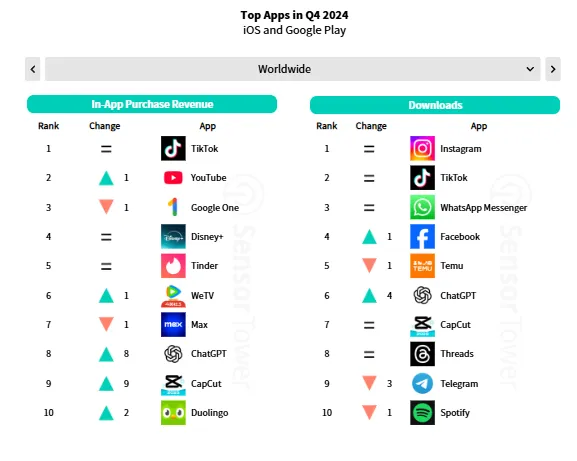

# TikTok Noticed Vital Progress in In-App Gross sales in 2024

In case you had any query as to why the U.S. is such a significant focus for TikTok, because it continues to battle for its survival within the area, this new perception, taken from Sensor Tower’s newest “Digital Market Index” report may assist:

“In-app buy income within the U.S. rose by $1.47 billion between This autumn 2023 and This autumn 2024, a bigger enhance than the remainder of the highest 5 markets mixed.”

And extra particularly:

“Customers spent a staggering $6 billion on in-app purchases in TikTok (together with Douyin in China), up from $4.4 billion in 2023. This was greater than double the income from every other app or recreation in 2024.”

In-app spending is the place Douyin, the Chinese language model of TikTok, makes all of its cash, which is why TikTok can also be seeking to construct its eCommerce enterprise.

Although I’m unsure concerning the mixed complete above. Possibly this contains Douyin purchases exterior of China solely, as a result of in accordance with studies, Douyin’s gross merchandise quantity (GMV) for 2024 reached 3.5 trillion yuan, or round $US490 billion.

Which is considerably greater than what Sensor Tower has steered right here, and Douyin’s ongoing GMV progress has been TikTok’s guiding gentle, when it comes to its personal in-stream procuring maximization.

If it could possibly get its TikTok Store parts proper, then the income alternative is huge, and because the above notes present, in-stream procuring is catching on with U.S. customers, albeit slower than it did in China.

And it’s the U.S. that’s main this cost, by a big margin, which, once more, is why TikTok is now preventing tooth and nail to make sure the app stays obtainable to U.S. customers.

It’s additionally working to broaden its eCommerce push in different markets, as a hedge towards a attainable U.S. ban. However the knowledge right here reveals why the U.S. market, particularly, is a significant focus, offering main alternatives, not simply when it comes to customers, but in addition with regard to driving that next-level revenue stream.

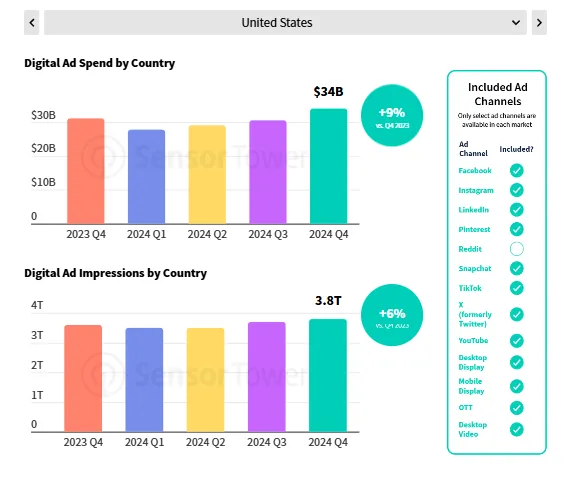

Sensor Tower’s This autumn cell market overview additionally contains notes on general advert spending progress, with This autumn breaking information within the U.S.

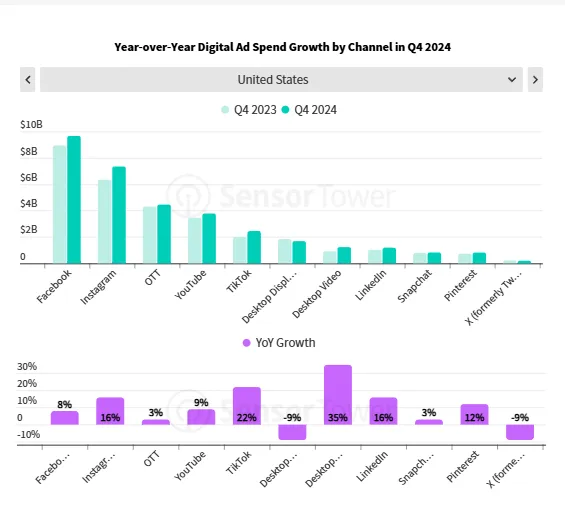

There’s additionally knowledge on advert spend by channel (the place LinkedIn and Pinterest noticed notable progress):

In addition to a highlight on retail media promoting.

Some helpful insights, which may assist to information your advert selections.

You may learn Sensor Tower’s full “This autumn Digital Market Index” report right here.

Andrew Hutchinson