# Tariffs Loom as Important Consider Social Platform Earnings Reviews

One of many key themes rising from the newest spherical of earnings studies from social media firms has been the projected impression of tariffs, and the way the extra charges that the Trump Administration is imposing on some areas will have an effect on their backside line.

Although most are eager to keep away from any dialogue of tariffs particularly, after Trump reacted angrily to studies that Amazon could look to begin displaying the impression of the tariffs on their merchandise costs.

As an alternative, Meta, LinkedIn, and Snap have tried to speak across the specifics, whereas nonetheless warning of how they’ll hit income consumption.

Meta’s CFO Susan Li, for instance, addressed a number of questions in regards to the Trump tariffs in Meta’s earnings name, and graciously side-stepped them with cautious wording.

“We now have mirrored the change in spend from these Asia-based e-commerce advertisers already into the income steering. In any other case, there’s simply actually plenty of places and takes within the financial surroundings. So it’s fairly tough to attempt to parse out very particular assumptions and the way they translate.”

In different phrases Meta’s backside line will likely be harm by the tariffs, with large Chinese language retailers like Temu and Shein already reducing advert spend. Certainly, Temu has been Meta’s single greatest advertiser over the previous couple of years, spending billions in 2023 and 2024, so inevitably, lowered market demand within the U.S., resulting from essentially greater costs, goes to have an effect. However Li and Meta stay assured that many of the impacts will likely be offset by various alternatives, and different advertisers filling the gaps.

“When it comes to impression on the public sale, we, after all, lose some income if massive advertisers scale back spend. And that, after all, places downward strain on worth, all issues equal. However we do have a broad and various enterprise. So, if some advertisers scale back their spend and costs fall, it creates a possibility for different advertisers to step in.”

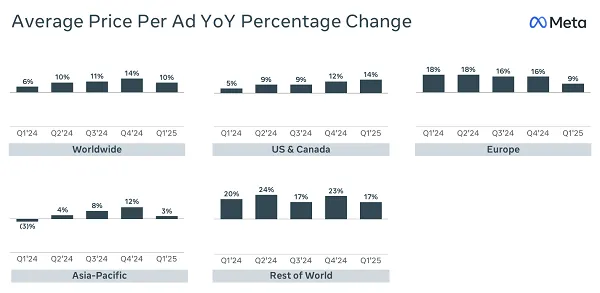

The profit for entrepreneurs, then, is that your Meta advertisements are about to come back down in worth. And with Meta’s advert costs steadily creeping up, that’ll be a internet optimistic for almost all of U.S. manufacturers.

Snapchat, in the meantime, is being extra cautious with its steering, after noting {that a} vary of advertisers have lowered their advert spend as a result of Trump Administration’s determination to finish the “de minimis” exemption, which enabled Chinese language suppliers to proliferate, both by way of the large firms or drop-shippers.

The de-minimis exemption has meant that imported items valued at lower than $800 can keep away from sure taxes, which has been a blessing for these identical suppliers importing items from China particularly. However The White Home has now excluded Chinese language-made imports from the exemption, as of Might 2nd.

Which, once more, will scale back advert spend at social platforms in consequence.

As reported by The Wall Road Journal:

“Income at Snap, Meta Platforms and different tech giants surged by billions lately, partially from China-based digital promoting. Shap shares fell 20% in after-hours buying and selling. The corporate declined to share formal steering for the second quarter, and executives mentioned the Snapchat-operator had skilled headwinds within the present quarter.”

The impression, from a enterprise standpoint, will inevitably be much less income, however for U.S. advertisers, once more, this may imply decrease costs for advertisements, resulting from lowered competitors for advert slots.

Although, the longer that these impacts are felt, the extra possible that the platforms will search to inject increasingly more advertisements, which might additionally result in issues.

Advert overload can flip customers off, and because the platforms search to prop-up their income, there’s a danger that customers received’t reply as favorably to over-saturated promotions. Or the platforms will invariably scale back advert requirements resulting from lack of competitors. In different phrases, extra crypto rip-off advertisements, and extra faux celebrity-endorsed meme coin promotions, making different platforms extra akin to the advert chaos at X, the place seemingly something goes in the mean time.

That’s most likely instance of the possible impression. X has misplaced a good portion of its advertisers since Elon Musk took over, and in consequence, its advert auctions are actually flooded with low high quality junk advertisements, that may be simply as off-putting as having too many advertisements displayed in-stream.

That additionally, presumably, reduces consideration on, and engagement with the platform’s advertisements total, with customers turning into extra attuned to only scrolling previous. Which, ultimately, can even impression efficiency.

However when it comes to direct impacts for entrepreneurs, from a basic perspective, the tariff pressures are prone to scale back competitors inside advert auctions resulting from large Chinese language manufacturers and drop-shippers decreasing their give attention to the U.S.

Conversely, that might improve advert costs in different markets, as these manufacturers look to different alternatives. However the U.S. stays their key goal, and the impression will likely be extra vital on this respect.

Andrew Hutchinson