# Snapchat’s Including Sponsored Snaps to Expands Its Advert Alternatives

Snapchat’s including some new advert placement choices, because it seems to construct on its latest advert enterprise development, whereas it’ll additionally quickly present extra insights into app utilization, so as to assist entrepreneurs higher perceive how persons are participating with totally different components of the app.

First off, on advert placements. The primary announcement from Snap is that it’ll quickly launch “Sponsored Snaps”, that are just about like LinkedIn’s sponsored InMails in Snap type.

As defined by Snapchat CEO Evan Spiegel:

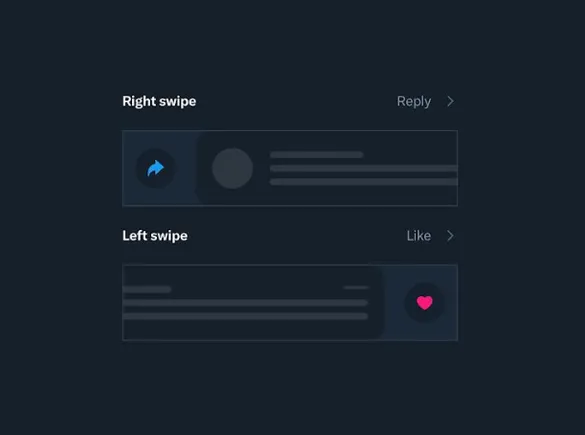

“Sponsored Snaps seem within the chat inbox as a brand new Snap and not using a push notification, and opening the message is non-obligatory. This enables advertisers to interact potential prospects all the way in which down the funnel all inside a single advert unit; increase consciousness with broad attain within the chat inbox, enhance consideration with individuals who select to view the Snap, and drive conversion with an in-message call-to-action.”

The Snapchat inbox has lengthy been sacred floor, and as such, it’s been exempt from promotional supplies. However now, as Snap seems to broaden its advert enterprise, it’s taking the leap into, primarily, paid DMs.

“As we proceed to evolve Sponsored Snaps, we’re excited to allow extra messaging options powered by generative AI and built-in into advertiser CRMs to assist our companions talk with their prospects at scale. As at all times, your conversations with buddies are non-public and will not be used for promoting functions.”

I’m undecided how Snap customers are going to take it, however on condition that sponsored posts are pretty frequent in different social apps, it’s unlikely to be wholly disruptive, and spark a significant backlash consequently.

However then once more, as Meta is aware of, promoting in individuals’s non-public DMs is usually not welcomed, and examples like LinkedIn’s Sponsored InMail are reflective of that invasive side (i.e. individuals don’t like them).

I doubt Snap customers are going to love them both, however on the opposite aspect, advertisers will certainly be eager to entry essentially the most engaged a part of the app.

Whether or not, in the end, that finally ends up being factor for Snap in the long term, nevertheless, stays to be seen.

Snapchat’s additionally including “Promoted Locations”, which can allow companies to focus on their shops on the Snap Map.

“With Promoted Locations, companies can use the Snap Map to succeed in incremental prospects who’re exploring locations close by, and simply measure the visitation carry with our closed-loop and privacy-safe measurement.”

Along with these new advert choices, Snap’s additionally rolling out extra analytics, to supply additional perception into how the app drives client behaviors:

“Within the coming months, we’re going to start out surfacing extra distinctive and actionable insights to advertisers based mostly on the range of engagement on Snapchat. Privateness-safe insights round retailer visitation powered by the Snap Map, interactions with Lenses via our digicam, and public content material posts in Tales and Highlight can assist advertisers drive higher efficiency and engagement with our neighborhood.”

Snap says that it’s going to deliver these insights right into a single, easy-to-use platform, so as to make it simpler to motion these information factors on your campaigns.

As famous, the updates are a part of Snap’s increasing concentrate on SMBs, versus making larger spending manufacturers the important thing goal of its advert enterprise.

As defined by Spiegel:

“Through the years, we’ve got discovered that decrease funnel income generated by small- and medium-sized prospects is extra predictable and steady than higher funnel income. It additionally represents a bigger long run alternative for income development. Decrease funnel income is ‘stickier’ as a result of it’s extra carefully tied to key enterprise goals and optimistic returns on advert spend, and as its scale will increase it turns into extra predictable as a result of it’s diversified throughout a bigger variety of advertisers and sectors.”

With this in thoughts, Spiegel says that the main focus for Snapchat’s advert enterprise transferring ahead will likely be on rising the variety of advertisers who’re targeted on decrease funnel targets.

And that’s already confirmed helpful. In its Q1 efficiency replace, Snap reported that the variety of small and medium sized advertisers within the app had elevated by 85% year-over-year.

Which is a large bounce, and as such, it begs the query as to why Snap didn’t put extra concentrate on SMBs all alongside? However then once more, Snap’s enterprise focus has at all times appeared barely misguided.

Again in 2017, a former Snap worker stated that Spiegel had as soon as outlined to employees that the app “is just for wealthy individuals,”, and that he didn’t need to “broaden into poor nations like India and Spain.”

Spiegel denied the declare, however it did, on the time, appear to align with Snap’s resistance to replace its Android app, in favor of iOS, which is extra fashionable in richer nations. Snap did finally replace its Android app in 2019, which then led to an explosion in development in India. That, in flip, noticed Snap put extra focus onto consumer development in creating markets as a key means to appease market analysts.

However then final 12 months, Snap re-assessed, as a result of whereas its energetic consumer depend was rising, its income wasn’t rising in step. Utilization development in decrease income markets wasn’t having the underside line impression that Snap wanted, which has now led to this new re-focus onto a broader set of SMBs, versus partnerships with larger names.

So, once more, Snap’s development technique has at all times appeared a bit confused, or misguided, which can be reflective of Spiegel’s personal immaturity as a enterprise chief.

And possibly now, Spiegel has discovered his classes on this respect, which can see Snap’s revised concentrate on actual money-making avenues drive ongoing success for the app.

The brand new strategy is clearly driving higher outcomes proper now, whereas Snap additionally continues to maintain a finger within the AR pie, as a possible future alternative.

The largest danger, nevertheless, is that sponsored Snaps may annoy its core consumer base, and disrupt the broader really feel of the app.

Andrew Hutchinson