#Bloodstained: Ritual of the Night time is getting a Journey crossover subsequent week

Table of Contents

Bloodstained: Ritual of the Night time is getting a Journey crossover subsequent week

There’s nonetheless content material to be added to Bloodstained

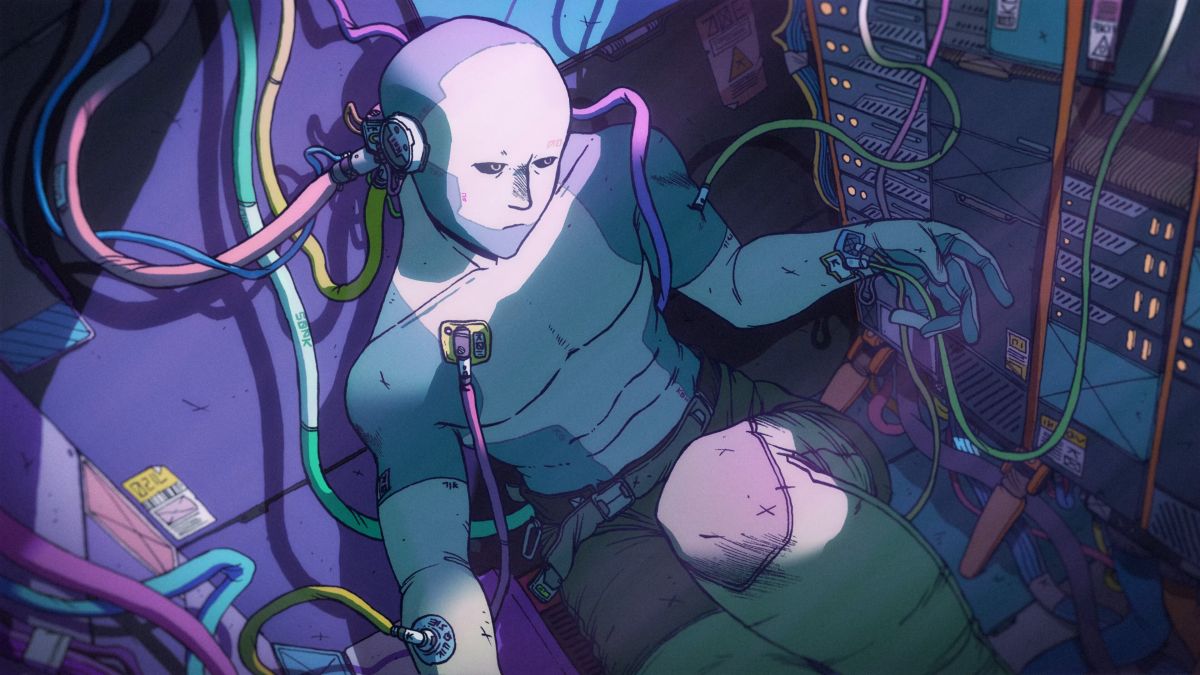

Bloodstained: Ritual of the Night time nonetheless has some extra journeys to undertake. Or, not less than one. Bloodstained is getting a Journey crossover replace on August 23, 2022.

The new crossover will add a wholly new part of the fortress, dubbed “The Tunnels,” impressed by thatgamecompany’s Journey. As soon as gamers have discovered the world, they’ll be capable of discover the depths and uncover new areas, although it would require some explorations and shard actions to navigate.

When you attain the tip, a ultimate boss battle awaits. And upon beating it, you’ll get an undisclosed particular merchandise that’s impressed by Journey.

Alongside the replace, the Bloodstained group can be issuing a couple of challenge fixes and tune-ups. With the intention to entry the brand new space, you’ll need to progress decently far into the sport. The doorway will seem after you’ve freed a sure character and gained entry to the Den of the Behemoths, although it’s not in the Den of Behemoths. As a result of it’s a brand new and hidden space, The Tunnels is not going to have an effect on map completion percentages or achievements.

Immortal life

This can be a actually neat replace, and I do take pleasure in each Bloodstained and Journey. The shock on this isn’t precisely coming from these two mashing up collectively, however the truth that Bloodstained remains to be getting content material updates.

Bloodstained: Ritual of the Night time launched in 2019, after a reasonably prolonged Kickstarter marketing campaign. [Disclosure: I backed the Bloodstained Kickstarter at the “get a copy of the game” tier.] It’s since had a bunch of crossovers, a retro-prequel sport that obtained its personal sequel, and a bunch of different content material all related to this Vania-style sport.

I’m not likely complaining, regardless that I haven’t gone again to Bloodstained to take a look at any of the additional content material. Regardless of years of Kickstarter improvement and extra, Bloodstained is maintaining it rolling with new stuff. We’ll see what particular tips Journey brings to Miriam’s arsenal subsequent week.