#Tips on how to get Shiny Sandygast and Shiny Palossand in Pokémon Go

Table of Contents

Each Pokémon Go coach is aware of the battle of catching a Shiny variant, one of many rarest creatures within the recreation. However, regardless of their rarities, there are a couple of methods that will help you even the percentages. For this information, we’ll present you learn how to get a Shiny Sandygast and Shiny Palossand in Pokémon Go.

The place to search out Shiny Sandygast in Pokémon Go

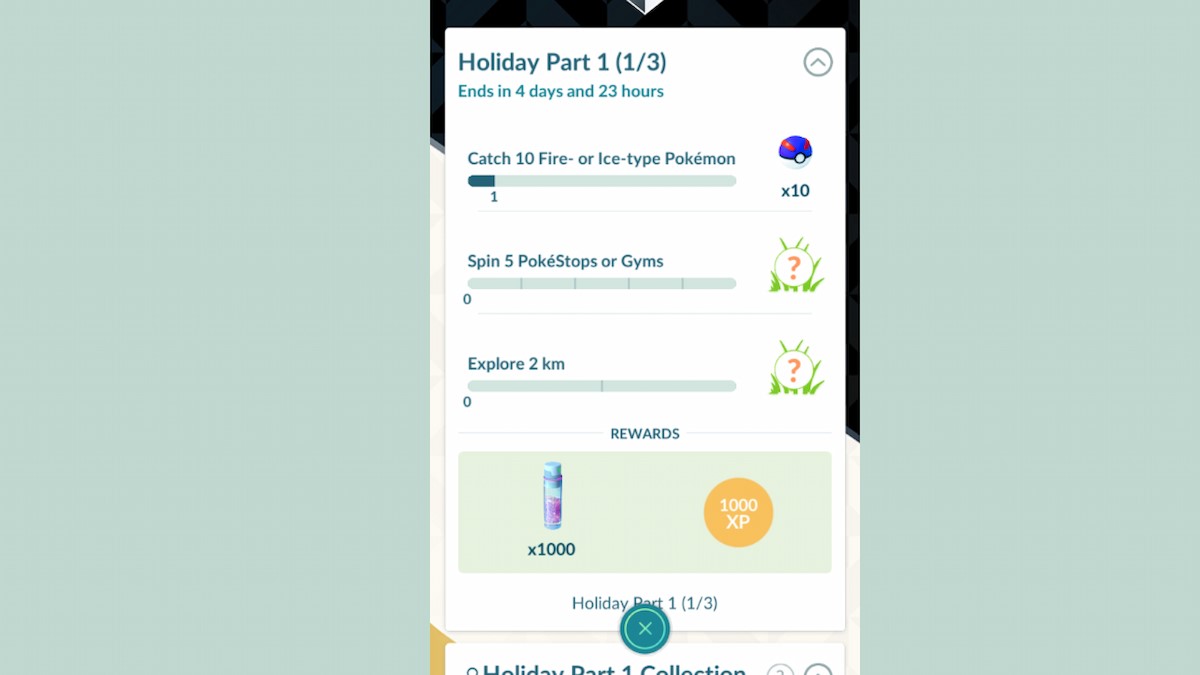

Shiny Sandygasts don’t seem too usually except an ongoing occasion will increase their spawn charge. Particularly, Pokémon Go’s Vacation Half 1 celebration provides you rather more probabilities, lasting from Dec. 17 to Dec. 22, 2024, at 9:59 a.m. native time. Whereas this occasion is energetic, you’ll be able to full the next duties to unlock a Shiny Sandygast in Pokémon Go:

- Take part in One-Star Raids

- Catch a Shiny Sandygast within the Wilds

- Full particular Analysis Duties

- Buying and selling

Compared to different methods, Analysis Duties provide a way more assured methodology for Shiny variant farming. For instance, the Vacation Half 1 occasion presents varied targets that reward you with Pokémon encounters. One in all these duties may lead to a Shiny Sandygast pull, so attempt to take a look at out your luck to see if it occurs. The targets proven there are additionally fairly easy to finish, reminiscent of spinning 5 PokéStops/Gyms and strolling for 2km.

Listed below are a couple of Analysis Duties that give you a potential Shiny Sandygast drop:

- Discover 2 km in Vacation Half 1 (1/3)

- Full all duties in Vacation Half 1 (Assist Spark)

- Full all duties in Vacation Half 1 (3/4 Monitor Sierra)

- Catch 10 Floor-Kind Pokémon (Subject-Analysis Process)

In addition to Analysis Duties, you can begin buying and selling with buddies. Though you’ll want to surrender one in all your personal Pokémon, it’ll nonetheless provide the Shiny Sandygast you’re in search of.

Tips on how to enhance your odds for Shiny Sandygast within the Wilds

Catching a Shiny Sandygast within the Wilds is likely one of the most tried and true strategies. The most effective factor you are able to do for that is to seize common Sandygast, which (hopefully) leads you to its Shiny kind. Nevertheless, in some instances, this methodology doesn’t work out, regardless of what number of Pokémon you’ve captured. So, when you’re presently experiencing this drawback, make the most of Climate Boosts, particularly with Foggy and Sunny climate. Sandygast thrives extra so on this climate, making them come out extra within the Wilds.

To spice up your probabilities even additional, make the most of Lure Modules and Incense. It’ll appeal to extra Pokémon briefly, luring all types of creatures in return.

Greatest counters to make use of in opposition to Sandygast in Pokémon Go

In case you’re able to duke it out with a Sandygast, use the next counters to defeat it simply in One-Star Raids:

- Kartana

- Mega Gengar

- Necrozma Daybreak Wings

- Primal Kyogre

- Shadow Tyranitar

- Darmanitan Galarian Zen

- Chandelure

Since Sandygast is weak in opposition to Water, Grass, Ice, Ghost, and Darkish varieties, using any of the Pokémon above is essential. It’s also possible to choose movesets with these varieties in thoughts, as they are going to deal vital injury to the creature. Even when you don’t have any of those Pokémon, you’ll be able to accept others that meet this standards.

Tips on how to get Shiny Palossand in Pokémon Go

To take it to the following stage, you’ll be able to evolve the Shiny Sandygast to unlock a Shiny Palossand in Pokémon Go. It’ll require 50 candies, which you’ll earn by transferring Pokémon or setting Sandygast as a Buddy.

In case you aren’t conversant in the transferring methodology, you’ll want to gather a complete bunch of Sandygast out within the Wilds. It’ll be simpler to do when sure occasions enhance its spawns. Then, when you accumulate sufficient, choose the duplicates in your assortment and select to switch them to the professor. The method can take some time, so attempt to seize as many Sandygast as potential to quicken the tempo.