#Discworld TTRPG smashes Kickstarter goal on day one among launch – Destructoid

A brand new tabletop role-playing recreation based mostly on Sir Terry Pratchett’s Discworld and created by Modiphius Leisure, has launched a marketing campaign on Kickstarter. Terry Pratchett’s Discworld RPG: Adventures in Ankh-Morpork had an preliminary aim of $130,000, which it eclipsed in simply 27 minutes.

The Kickstarter undertaking has now reached $1 million in pledges, unlocking all however the final two stretch objectives. With three weeks left on the marketing campaign, it’s probably that these will even be unlocked. Achievement is anticipated in August 2025.

The Discworld collection of fantasy books was written by English creator Sir Terry Pratchett, beginning with The Color of Magic in 1983 and culminating with The Shepherd’s Crown in 2015. The disc-shaped world sits on prime of the again of 4 elephants who, in flip, are standing on the again of an enormous turtle referred to as Nice A’Tuin.

There are greater than a thousand characters named all through the 41 books within the collection. Sir Terry was identified for creating deep characterization and a satirical, hilarious tackle life – a mix followers will hope to see within the ultimate product of this marketing campaign.

Followers of the collection, and RPG followers searching for one thing a bit of totally different from the standard fare (assume extra Dungeon Crawl Classics than Dungeons & Dragons), can again the Discworld Kickstarter now.

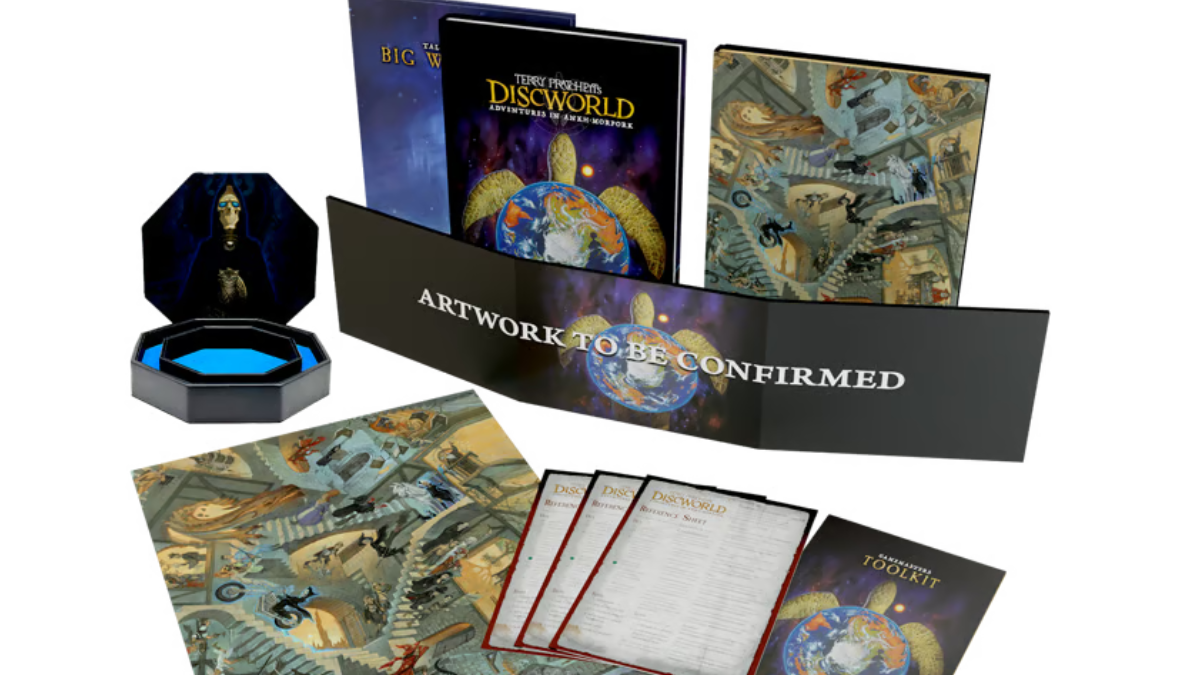

The sport is being created by Modiphius Leisure, which has appreciable expertise making tabletop RPGs. They’re the crew behind Dishonored, Dragonbane, and Lord of the Rings role-playing video games in addition to Fallout: Factions and The Elder Scrolls: Name To Arms wargames. It says it has aimed to translate Pratchett’s humor into an immersive and playable role-playing recreation. Pledge ranges vary from a PDF model of the rulebooks and companion objectives to the complete collector’s model that features bodily books signed by legendary artist and longtime Sir Terry collaborator Paul Kidby.

Stretch objectives, most of which have already been met, embrace cube units, duplicate watch badges, and character sheet postcards.

The primary collection of Discworld RPG adventures will likely be set in Ankh Morpork, Discworld’s most celebrated (for those who can name it that) metropolis. Gamers can create distinctive characters, selecting whether or not to play as members of the watch, a scholar of the murderer’s guild, one of many wizards of Unseen College, or any of the opposite teams of town. Modiphius has mentioned that if the primary launch goes properly, they may return to create adventures set in different areas, together with Lancre.

This isn’t the primary Discworld RPG: Sir Terry Pratchett partnered with recreation designer Phil Masters in 1998 to create GURPS Discworld. It was the primary to make use of the GURPS Lite guidelines, which had been included within the GURPS Discworld e-book, which meant gamers didn’t have to purchase the core rulebook itself. A sequel, GURPS Discworld Additionally, was revealed in 2001 by Steve Jackson Video games, once more in partnership with Sir Terry.

Different video games have additionally been revealed set within the legendary world. Discworld and Discworld II had been point-and-click adventures for the PC, that includes the voice of Eric Idle as Rincewind the “wizzard”. Nonetheless, even these video games, revealed in 1995 and 1996 respectively, had been predated by the 1986 text-based journey recreation The Color of Magic on the ZX Spectrum, Amstrad CPC, and Commodore 64.

Board video games Ankh Morpork, Guards! Guards!, The Witches, Clacks, and Thud are additionally out there, though some may be tough to search out as a result of they’re out of print and in style with collectors.